Zero rated GST will be applicable on future appointments even though they have been booked before the GST rate change. Previously only certain goods and services.

Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

. The Goods and Services Tax GST in Malaysia will be set to zero percent 0 effective 1 June 2018. GST is a broad based consumption tax covering all sectors of the economy ie all goods and services made in Malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the Minister of Finance and published in the Gazette. Businesses are eligible to claim input tax credit in acquiring these supplies and charge GST at zero rate to the consumer.

Malaysias GST is zero-rated starting from 1 June 2018. GST Tax Codes for Purchases GST code Rate Description TX 6 GST on purchases directly attributable to taxable supplies. After you change the tax group rate from 6 to 0 in Zenoti when you open any invoice that has a GST rate of 6 a link to recalculate appears.

Depending on the nature of your services you may be required to determine your customers belonging status ie. When you click the link a 0 tax is applied on the invoice and the price is. Download form and document related to RMCD.

Business owners in Malaysia. After spending the last several hours and night reading through the GST Act talking to tax accountants GST experts and scouring. Malaysias GST is zero-rated starting from 1 June 2018.

Article Posted date 16 November 2021. Here is what companies should know about the change in the tax environment of the country. In a statement the Ministry said that the reduction of the rate from.

Whether the customer is a local or an overseas entity. GST shall be levied and charged on the taxable supply of goods and services. Businesses are eligible to claim input tax credit in acquiring.

GST shall be levied and charged on the taxable supply of goods and services. A specific Sales Tax rate eg. Image via Bernama via NST.

How GST works on a zero rated supply. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones. The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May.

Your services are considered international services which are zero-rated ie. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. The Goods and Services Tax GST will be set to zero percent 0 effective from 1 June 2018 as announced by the Ministry of Finance Malaysia on 16 May 2018.

So the standard-rate will automatically become zero-rated come 1 June but exempt supply will remain exempted from tax. Typically the Zero-Rated ZR code is reserved for zero-rated supplies such as beef rice sugar water and electricity. The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced today.

This article relates to the Goods Services Tax which was introduced in April 2015 but was subsequently replaced with the Sales Service Tax in September 2018. These are taxable supplies that are subject to a zero rate. GST zero-rating for sales of exported goods.

2 Where a taxable person supplies goods or services and the supply is. 030 Malaysian ringgits MYR per litre is applicable. All supplies of local and imported goods and services which are now subject to GST at the standard rate of 6 will be subject to GST at zero rate 0 beginning 1 June 2018.

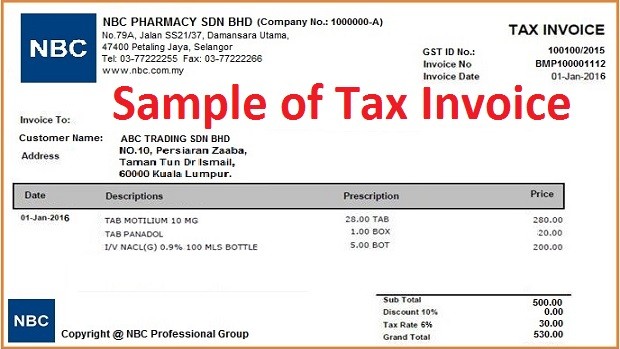

Companies are still required to adhere to the zero-rate and continue to comply to all GST requirements under the current legislation which includes the issuance of tax invoices GST tax codes. Computation of GST on zero rated supply. The Goods and Services Tax GST will be zero-rated for all items and services in Malaysia from June 1 2018 the Finance Ministry announced today.

IM 6 GST on import of goods. These are taxable supplies that are subject to a zero rate. The GST will be fully scrapped after the government repeals the Goods.

As such the rate reduction from the current 6 to 0 will be reflected on transactions related to MYXpats charges from 1 June 2018 onwards. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. How GST works on a zero rated supply at the wholesale level.

Malaysias unpopular 6 per cent GST was zero rated by the new Mahathir Mohamad administration to fulfil an election promise. In Malaysia theres standard-rated which is 6 zero-rated 0 and exempt GST. 1 A zero-rated supply is a any supply of goods or services determined to be a zero-rated supply by the Minister under subsection 4.

The ministry said the GST will no longer be imposed at a rate of 6 per cent from then on adding that this will be subject to further notice. GST is charged at 0 if they fall within the provisions under Section 21 3 of the GST Act. And b any supply of goods if the goods are exported.

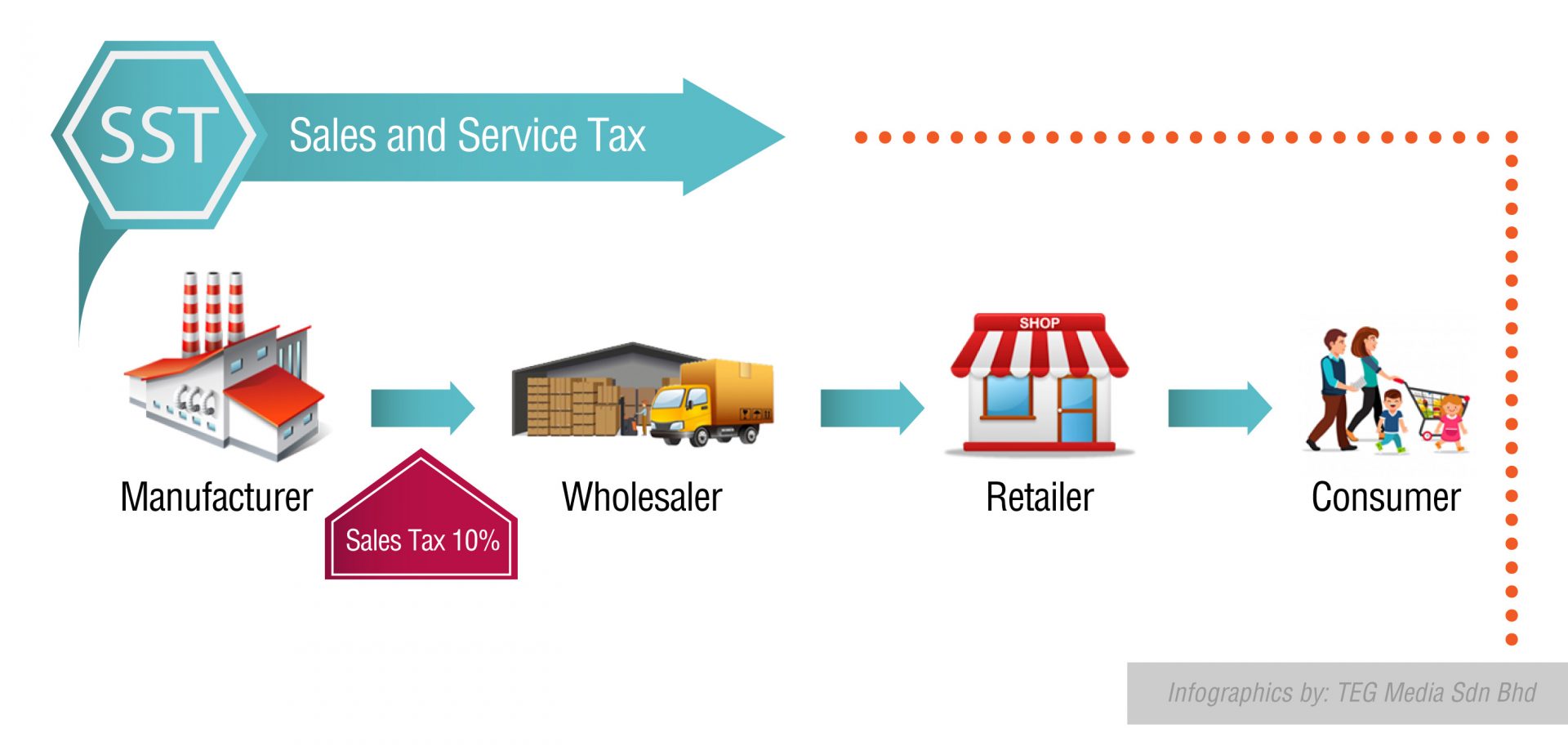

Dont panic this one only requires a short explanation. The Standard-Rated SR code is for. The second policy is the change in GST rate of six per cent to zero from today onwards and the expected introduction of the Sales and Service Tax SST system in September which the report said will likely reduce the CPI by a similar 02 to 03 percentage point.

The existing standard rate for GST effective from 1 April 2015 is 6. The Goods and Services Tax GST will be set at zero percent beginning June 1 2018 says the Finance Ministry. In other words no effect la so we dont have to go too deep into this.

The Goods and Services Tax GST Board of Reviewin a decision favourable to the traderaddressed the tax authoritys decision to deny zero-rating for exports of goods that were hand-carried by motor vehicle to customers in Malaysia.

Sst Vs Gst How Do They Work Expatgo

Gst Zero Rated Honda Absorbs 6 Gst For Civic City Cr V And Hr V Rebates Up To Rm9 5k May 18 31 Paultan Org

Overview Of Goods And Services Tax Gst In Malaysia

Pdf Impacts Of Goods And Services Tax On Income Distribution In Malaysia

Understanding Goods And Services Tax Ppt Download

Sst Vs Gst How Do They Work Expatgo

Malaysia Post Election Income Tax And Gst Updates Cheng Co Group

Gst Zero Rated Nissan Rebates Begin Ahead Of June 1 Paultan Org

Malaysian Gold Market To Benefit From The Removal Of Gst As A New Government Takes Over

Lexus Penang Zero Rated Gst For All Lexus Models Come Experience Amazing At Lexus Penang This Weekend 26th 27th May 2018 9am 6pm Please Contact Our Friendly Sales Consultant For Further Details Showroom

What Is Exempt Supply In Gst Goods Services Tax Gst Malaysia Nbc Group

Gst May Burn Hole In Poors Pockets Business Standard News

Daihatsu Announces New Prices With Zero Rated Gst Bigwheels My

Daihatsu Announces New Prices With Zero Rated Gst Bigwheels My

Overview Of Goods And Services Tax Gst In Malaysia

What Is Exempt Supply In Gst Goods Services Tax Gst Malaysia Nbc Group